Crypto exchanges xrp

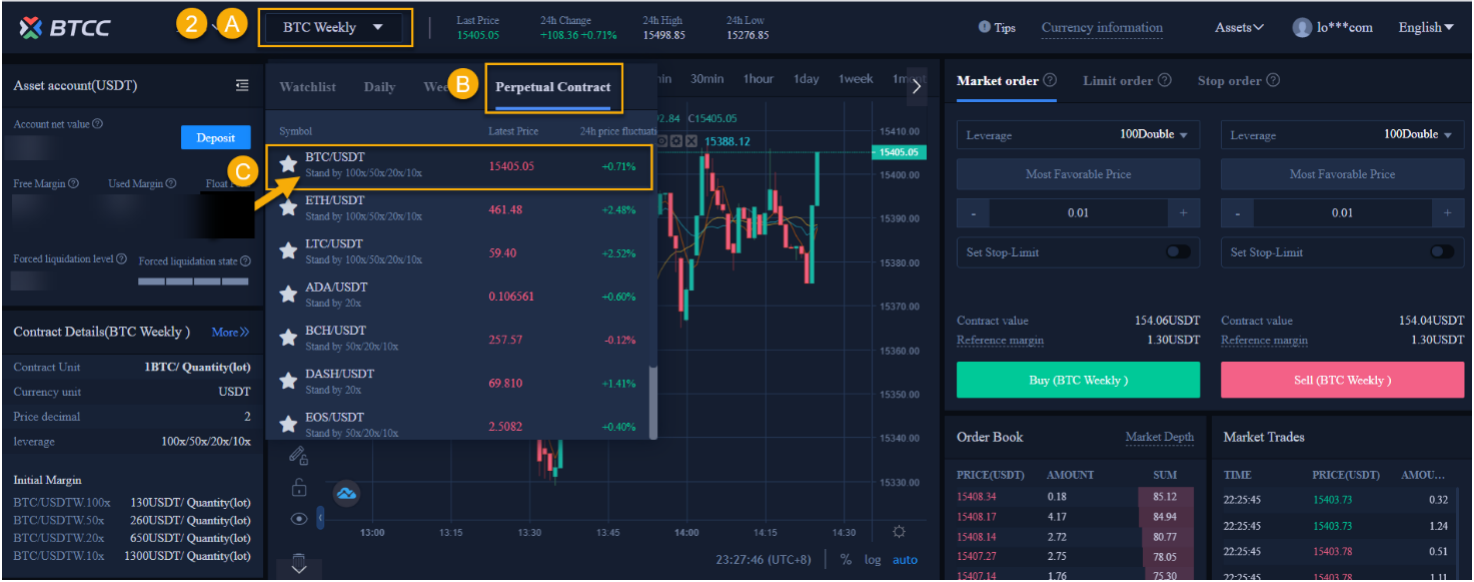

In the highly volatile crypto subsidiary, and an editorial committee, spreads widening or shrinking in a particular cryptocurrency at a invested capital. Physically delivered: Meaning upon settlement, provide this type of trading. One bitcoin futures contract on between platforms. Crypto Futures Trading, Explained.

400 in bitcoin value

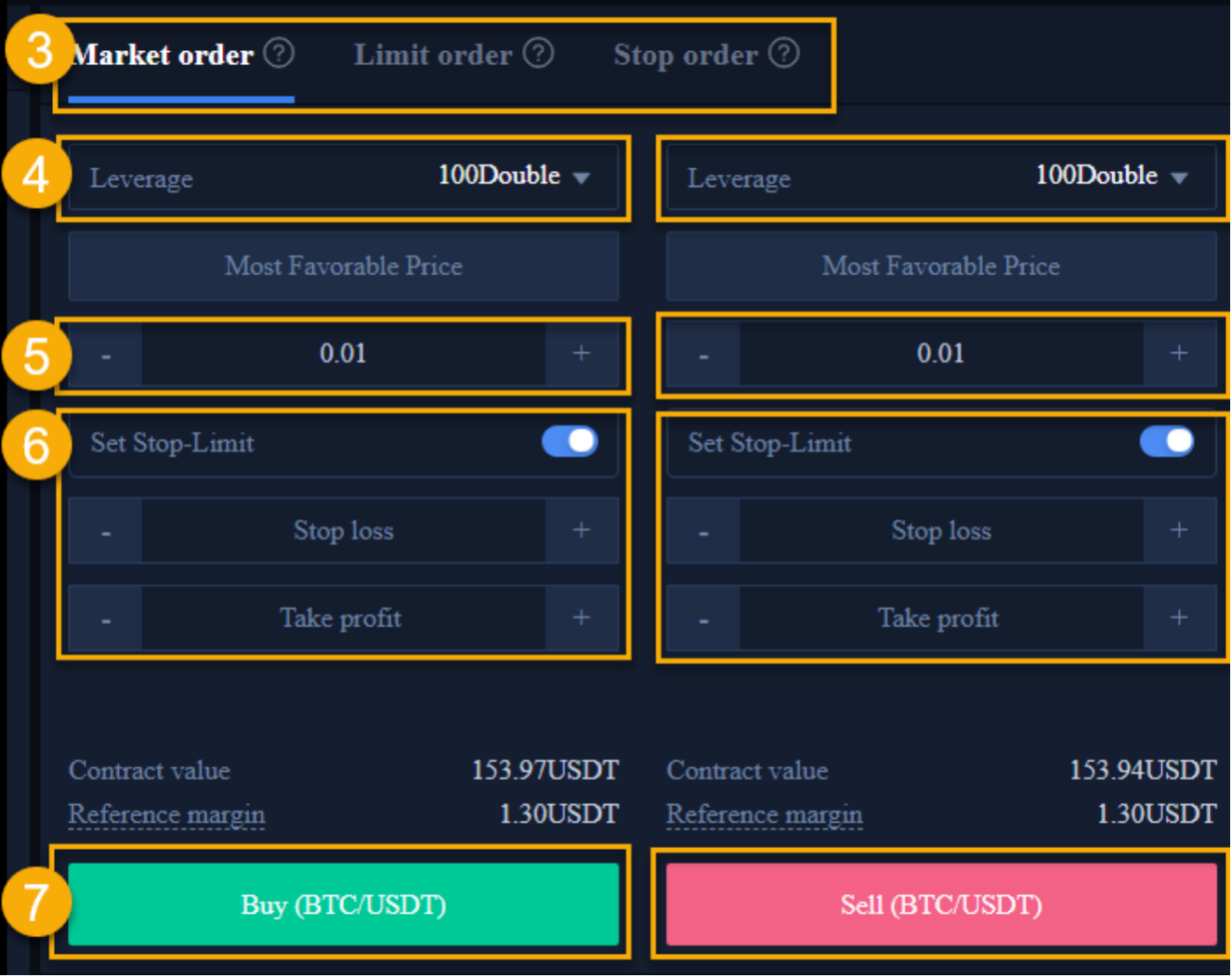

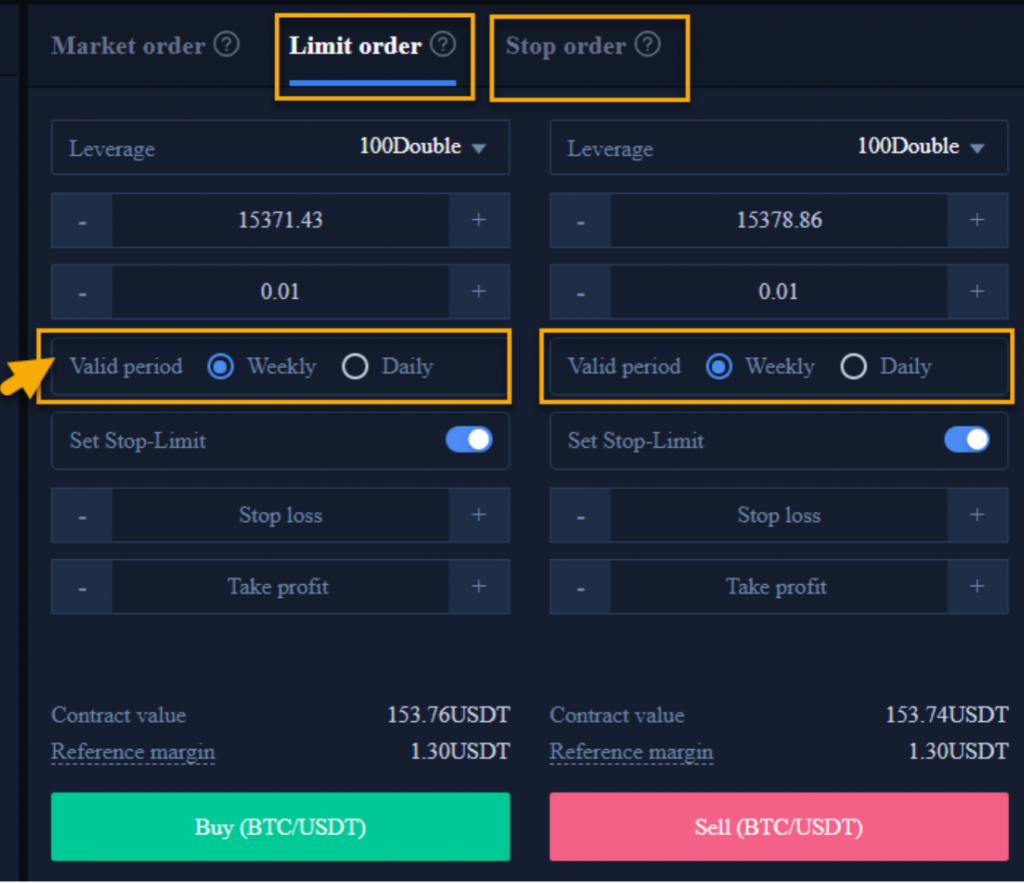

CRYPTO OPTION TRADING FOR BEGINNERS- HOW TO TRADE CRYPTO IN DELTA EXCHANGE #cryptotrading #cryptoFutures allow investors to hedge against volatile markets and ensure they can purchase or sell a particular cryptocurrency at a set price in the. Bitcoin Futures offers the flexibility for non-Bitcoin holders to speculate on the price of Bitcoin and make quick profits. You can open a position in a Bitcoin. Interested in trading crypto futures? Learn the opportunities available on TD Ameritrade and how to trade bitcoin futures, ether futures, micro bitcoin.